/THIS NEWS RELEASE IS NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR DISSEMINATION IN THE UNITED STATES/

- Kincora intends to raise up to $6m at $0.10 per Unit with a full warrant

- Cornerstone investment from existing holder of approximately 28% shares

- Strong support from insiders, other existing and new investors

- Proceeds will be used to fund drilling for discovery at 5 independent and large scale porphyry targets and earlier stage project pipeline activities

- Up to 18,000 metres of drilling

VANCOUVER, May 7, 2019 – Kincora Copper Ltd. (the “Company“, “Kincora“) (TSXV:KCC) announces that it proposes to undertake a private placement (the “Offering“) of units at $0.10 per unit (the “Units“) to raise up to $6,000,000. The Units will be comprised of one share (a “Share“) and one warrant (a “Warrant“), each Warrant entitling the holder to acquire a further share at a price of $0.25 for a term of 2 years.

The Company is pleased to announce that following an independent technical review of Kincora’s targets and proposed work programs, our largest shareholder, LIM Asia Special Situations Master Fund Limited (“LASSMF“), will (subject to satisfactory documentation) subscribe for its pro rata share of the Offering (which is approximately 28% as at the date hereof). The Company is also pleased to have received strong indicative support from insiders, many existing and new shareholders.

Chairman Cameron McRae commented, “I am delighted that we have attracted a strong cornerstone position from our largest shareholder and such interest from other experienced institutional resource sector specialist and high net worth investors. The support and detailed due diligence processes provide validation of our drill targets, strategy and team.

This offering has been structured to align the immediate and medium term capital markets strategy to our asset portfolio of 5 standalone, large and drill ready porphyry targets. Success on any one of these targets would indicate a new globally significant copper discovery.”

Sam Spring, President and CEO, noted, “The offering will provide a strong foundation for the drill bit to again drive Kincora’s valuation going forward, ramping up our exploration and expansion activities.

Since consolidating the dominant position in the Southern Gobi copper belt in late 2016 and attracting a world-class technical team in 2017, Kincora has been undertaking the first modern systematic district scale exploration program in this highly prospective under-explored copper belt. Kincora’s technical team has an exceptional track record of discoveries, and this offering supports the first target testing drilling program under their watch.

Our drilling strategy today is the culmination of almost 30 years of cumulative copper exploration experience in this belt by the senior members of our exploration team, 5 years of exploration work and model refinements by ourselves and previous owners (including Ivanhoe Mines and IBEX) that provide us with high conviction to now focus on the 5 large and independent targets within our Bronze Fox and East Tsagaan Suvarga projects.

For their respective stages of exploration these targets are considered as good as you get within a global setting. The independent technical review commissioned by our largest shareholder supported a “discovery” having already been made at Bronze Fox within the underexplored target zone to the west of a key regional fault. This target area has been significantly upgraded by recent exploration activities. Confirmation of our geological models with positive results from the proposed drilling have the potential to, in time, elevate both projects to Tier 1 or world-class status.1

We’re very pleased to have support from our investors, local community, hard working team and look forward to working closely with stakeholders going forward.”

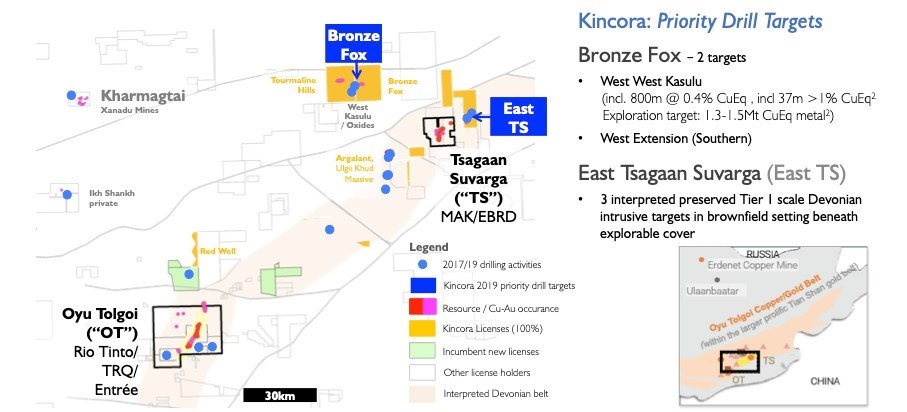

Exhibit 1: 5 independent and large-scale drill ready porphyry targets at two mineralised projects, Bronze Fox and East Tsagaan Suvarga, across the district scale license portfolio in the Southern Gobi copper belt

Reinterpretation of existing data (including relogging and block model analysis of over 24,000 metres of drilling at Bronze Fox), the acquisition of additional geophysical data (induced polarization, gravity and magnetics at both projects) and first phase drilling at East Tsagaan Suvarga (“East TS”) have advanced both projects significantly resulting in new and exciting geological targets – in total 5 now large scale and independent targets proposed for drilling.

Proceeds of the Offering will support up to 18,000 metres of drilling in multiple work programs primarily within two known mineralised projects, Bronze Fox and East Tsagaan Suvarga, and advancing our earlier stage pipeline and expansion strategy. Key work programs will be:

- At the Bronze Fox project: Up to $2.2m expenditure on drilling between 4,500-8,100 metres, resource definition and mining license conversion;

- At the East Tsagaan Suvarga project: Up to $1.3m expenditure on Phase 2 drilling of between 4,500-6,200 metres; and,

- Expansion, pipeline & G&A: Up to US$1m on project generation for up to 4,000 metres of drilling; $0.6m for earlier stage project pipeline exploration work ($0.6m); and, $0.9m for general working capital.

Bronze Fox

At the wholly owned Bronze Fox project drilling is planned at two new targets in the western and preserved monzodiorite zones where previous drilling by Kincora returned higher-grade intersections. The monzodiorite target areas sit across a key regional fault and in a different mineralising system to the outcropping granodiorite zone that has been the focus of previous exploration activities of Ivanhoe Mines and Kincora.

These higher grade intersections include three of four holes drilled by Kincora that returned greater than 1% copper at the West West Kasulu prospect, including hole F62 which hosted 13m of 1.15% Cu or 1.41% CuEq, within 37m at 0.83% Cu or 1.04% CuEq and 794m at 0.40%CuEq2.

A scissor hole to F62, the anticipated first high priority hole of the 2019 drilling program, will for first time test the strongest and core chargeability high zone coincident with the deep seated magnetic low at Bronze Fox, drilling into the monzodiorite zone which supported the 37m at >1%CuEq intersection.

The West Kasulu prospect at Bronze Fox has an independently defined exploration target of 416Mt to 428Mt grading 0.26% to 0.30% copper for up to 2,437Mlb of copper and 0.84Moz gold, including 141Mt for 890Mlb of copper and 0.25Moz gold in the monzodiorite zone at West West Kasulu3.

The 2019 field season drilling program is designed to advance the strike potential away from the fault to the west in two preserved monzodiorite systems, the West West Kasulu and Southern Western trend targets, and demonstrate the interpreted significant increase in tonnage and grade potential.

East Tsagaan Suvarga

Kincora’s wholly owned East Tsagaan Suvarga (“East TS”) project is located approximately 10-15 kms to the east of the Tsagaan Suvarga porphyry Cu/Au mine (“TS“), which is under development on the western margin of the Tsagaan Suvarga Intrusive Complex on a transverse structure. Tsagaan Suvarga has had over US$370 million invested to date and is forecast to produce 316,000t Cu and 4,400t Mo pa.

Importantly, the Tsagaan Suvarga deposit is hosted in Devonian age rocks, which also host the Oyu Tolgoi cluster of deposits that include the high-grade Hugo Dummet and Heruga mineralization within a preserved porphyry setting. This latter series of orebodies underpin Oyu Tolgoi’s potentially 100-year mine life being scheduled to be the world’s third largest copper mine.

Kincora’s geological concept that 2019 drilling is seeking to confirm is that Hugo and/or Heruga style mineralization may be present beneath the younger cover in the East TS tenement in a favorable preserved porphyry setting. This is supported from being on the eastern margin of the same Devonian intrusive complex as Tsagaan Suvarga, first phase drilling and subsequent encouraging geophysics.

Within a confirmed brownfield and preserved porphyry environment, a maiden target testing drill program is proposed by Kincora seeking to test three independent targets at East TS, which like at Oyu Tolgoi, sit within a favourable structural setting and Devonian age intrusion below a carboniferous cap. These targets are interpreted as a series of intrusions supporting the concept of preserved higher-grade orebody(s) within the Tsagaan Suvarga mineralised system at moderate depths. Each of the three targets at East TS are large in scale potential, with individual coincident geophysical anomalies equivalent to Hugo in size at Oyu Tolgoi, or SolGold’s Alpha discovery, but at interpreted shallower depths.

Applications and Closing of the Offering

The Company has set a record date of May 3rd, 2019 for determining the eligibility of a subscriber to the Offering to rely on the “Existing Shareholder Exemption” from prospectus requirements. The Existing Shareholder Exemption is to encourage participation from all existing shareholders without requiring the time and cost commitment of a full prospectus.

Kincora is pleased to have secured cornerstone support from LASSMF, the Company’s largest shareholder, for its pro rata share of the Offering (which is approximately 28% as at the date hereof). The Company is also pleased to have received strong indicative support from insiders, many existing and new shareholders.

The Offering is proposed to close May 22nd, 2019 and Units will be allocated on a pro rata basis if the Offering is over-subscribed. The Company may however elect to increase the size of the Offering to accommodate subscribers, subject to the consent of the TSX Venture Exchange.

In light of market conditions, the Company has sought to structure the Offering in terms of size, pricing and warrants, to align the immediate and medium term funding needs to its exploration strategy across the described 5 targets, earlier stage exploration pipeline and expansion plans.

For the warrants to be in-the-money implies a pre-money market capitalization of the Company of up to $33 million, versus Kincora’s previous $40-50 million market capitalisation when drilling hole F62 at Bronze Fox (which the independent technical review commissioned by LASSMF saw as a “discovery” hole). The current valuations of other Canadian listed copper porphyry exploration plays in emerging market jurisdictions also provides supportive valuation parameters for the Offering warrants to likely be in-the-money upon exploration success.

Exercise of the warrants would provide Kincora with up to a further $15 million of funding for further drilling and project development optionality, including potential strategic transactions at the asset level.

Closing is subject to receipt of approvals of the TSX Venture Exchange. All Shares and Warrants issued in connection with the Private Placement will be subject to a four (4) month hold period.

The Company may pay finders’ fees in connection with the Offering in accordance with the policies of the TSX Venture Exchange.

|

Notes |

|

|

All amounts are expressed in Canadian dollars unless stated otherwise. |

|

|

1 |

The Company recognises that the terms “World Class” or “Tier 1” are subjective and the Company’s targets are conceptual in nature, yet to be supported by drilling results to support an sufficient understanding of their potential grade or scale, let alone potential economics that are commonly associated with such terms. However, both the Bronze Fox and East TS projects have complementary geological and geophysical characteristics, with significant target zone potential and are in known mineralised systems in a proven prolific but underexplored copper porphyry belt. It is the view of the Company that confirmation of our geological models with positive results from the proposed drilling have the potential to demonstrate, and in time, elevate both projects to Tier 1 or world-class status. |

|

2 |

F62 – 37m grading 0.83% copper and 0.14g/t gold (1.01% CuEq) from 573m, within 391m @ 0.50% CuEq (0.41% copper and 0.08g/t gold) and 794m at 0.40% CuEq. The Copper Equivalent (CuEq) calculation represents an estimate for the total value for each metal, multiplied by the conversion factor, summed and expressed in equivalent copper percentage based on spot prices (Cu $3.11/lb, Au $1279/oz and Mo $7.1/lb). Grades have not been adjusted for metallurgical or refining recoveries and the copper equivalent grades are of an exploration nature only and intended for summarizing grade. The copper equivalent calculation is intended as an indicative value only. |

|

3 |

The potential quantity and grade is conceptual in nature, and based on nearest neighbour and ordinary krige estimates within an interpreted 0.2% Cu grade shell based on 81 drill holes spaced approximately 200 x 200 m within the West Kasulu prospect within the western central portion of the Bronze Fox Intrusive Complex. The drill spacing is too broad to define grade continuity, but does illustrate geological continuity. No assumptions regarding eventual economic extraction have been applied. The potential quantity and grade is conceptual in nature, there has been insufficient exploration to define a mineral resource and it is uncertain if further exploration will result in the target being delineated as a mineral resource. |

|

For further details please refer to the January 25th, 2018 press release “Large copper-gold porphyry target quantified at Bronze Fox” Click Here |

|

About Kincora

Kincora Copper Limited operates in the Gobi region of South Mongolia. It has a dominant land position and is undertaking the first modern systematic district scale exploration centred on the drill ready Bronze Fox and East Tsagaan Suvarga (ETS) porphyry projects. This wholly owned portfolio has attracted a first-class technical team who are credited with multiple discoveries of Tier 1 copper deposits.

Reinterpretation of existing data (including relogging, and block model analysis, of over 24,000 metres of drilling at Bronze Fox), the acquisition of additional geophysical data (Induced Polarization, gravity & magnetics at both projects) and first phase drilling at East TS under the watch of the current technical team since late 2016 have advanced both projects significantly resulting in new and exciting geological targets.

All data has been iteratively interpreted in a technically rigorous workshop format by the Kincora in-house technical team with appropriate involvement of specialist consultants of their respective field and advisors to the technical committee. This has ensured that quality targets have been identified and prioritised for drilling, with a detailed multiple target, multiple phase drill programs budgeted at Bronze Fox and ETS (and fully permitted).

These targets sit in the “target testing” to “advanced drilling” phases of a projects development, which for copper porphyries offers the maximum uplift in project (and shareholder) value. These targets, for their respective stages of exploration, are considered “as good as you get within a global setting”. Confirmation of our geological models with positive results from the proposed drilling have the potential to demonstrate, and in time, elevate both projects to Tier 1 or world-class status1.

For further information: www.kincoracopper.com

- Exploration strategy 2019: Click Here

- Corporate strategy: Click Here

- “Introduction to Mongolia” presentation: Click Here

- https://twitter.com/KincoraCopper

Qualified Person

The scientific and technical information in this news release was prepared in accordance with the standards of the Canadian Institute of Mining, Metallurgy and Petroleum and National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and was reviewed, verified and compiled by Kincora’s geological staff under the supervision of Peter Leaman, Senior Vice-President of Exploration of Kincora Copper, who is the Qualified Person for the purpose of NI 43-101.

Forward-Looking Statements

Certain information regarding Kincora contained herein may constitute forward-looking statements within the meaning of applicable securities laws. Forward-looking statements may include estimates, plans, expectations, opinions, forecasts, projections, guidance or other statements that are not statements of fact. Although Kincora believes that the expectations reflected in such forward-looking statements are reasonable, it can give no assurance that such expectations will prove to have been correct. Kincora cautions that actual performance will be affected by a number of factors, most of which are beyond its control, and that future events and results may vary substantially from what Kincora currently foresees. Factors that could cause actual results to differ materially from those in forward-looking statements include market prices, exploitation and exploration results, continued availability of capital and financing and general economic, market or business conditions. The forward-looking statements are expressly qualified in their entirety by this cautionary statement. The information contained herein is stated as of the current date and is subject to change after that date. Kincora does not assume the obligation to revise or update these forward-looking statements, except as may be required under applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.