Be the first to know about the new significant copper-gold discoveries

LACHLAN FOLD BELT

Multiple world-class mines with multiple deposits

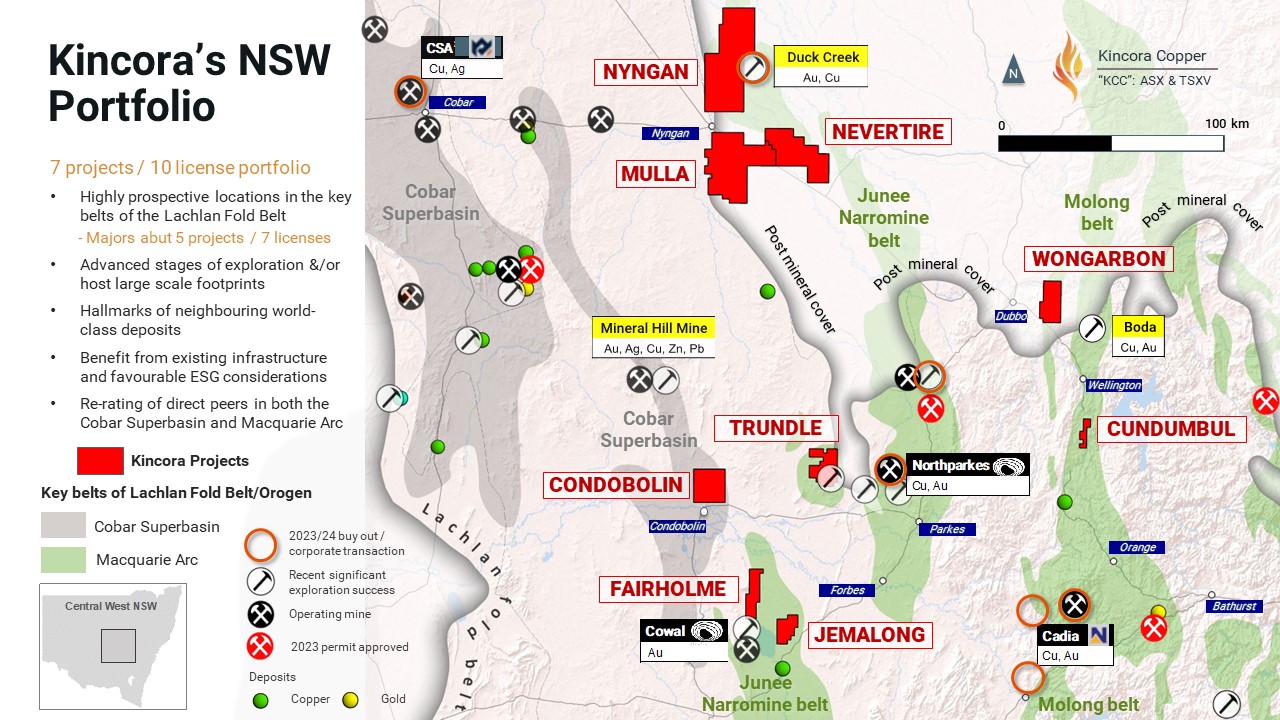

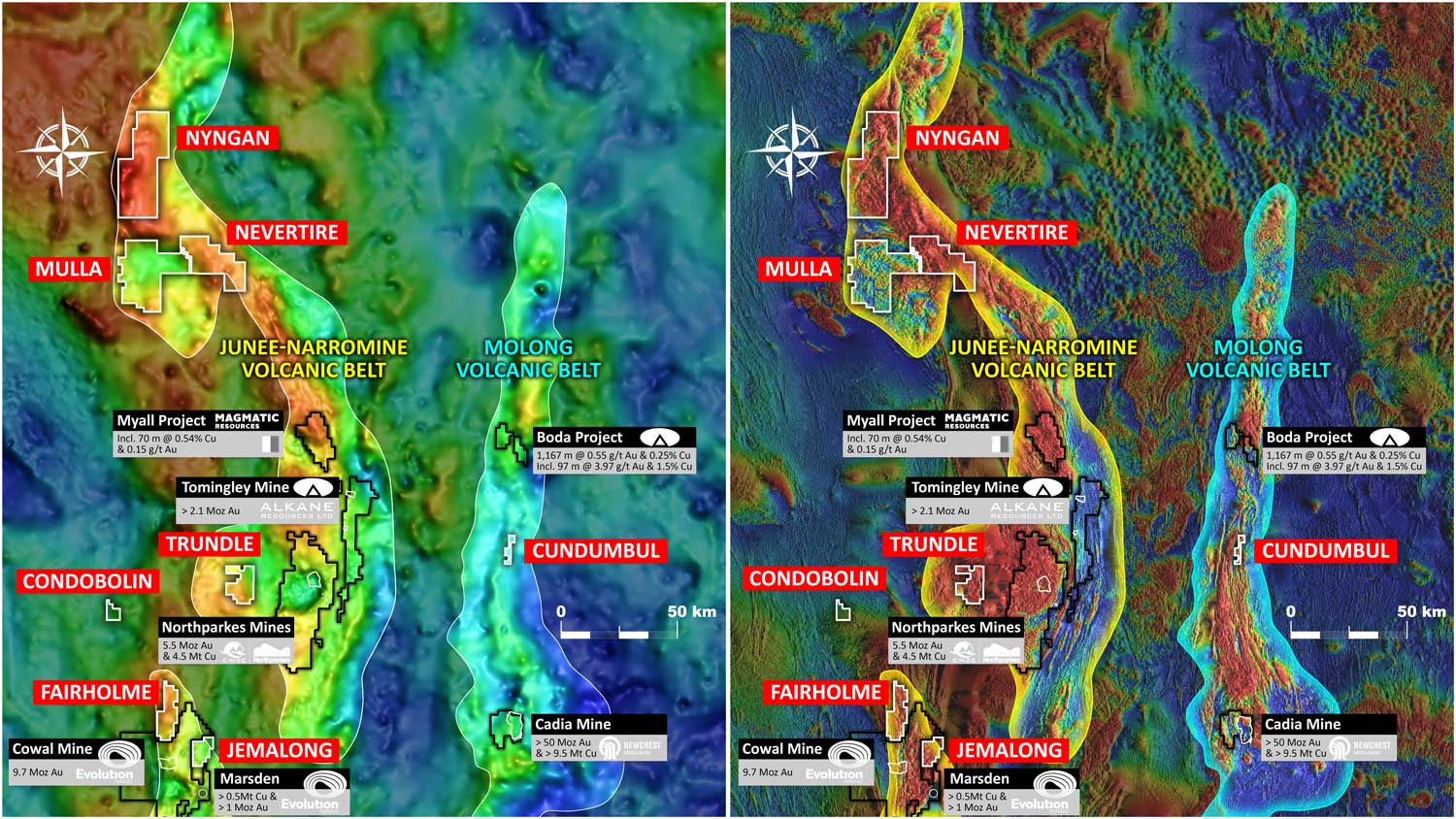

Kincora holds a wholly owned district-scale project portfolio in the Central-West of New South Wales (NSW), centered on Australia’s prolific Macquarie Arc and Cobar Superbasin of the Lachlan Fold Belt. The region is a world class Gold-Copper province and the Macquarie Arc is Australia’s foremost porphyry district.

The corporate appeal of the district is evident from recent multiple billion dollars of M&A. These transactions include one of the worlds’ most profitable hard rock projects (Cadia), the CSA mine (A$1.3 billion) and Northparkes (80% for up to A$720m).

Recently there has also been significant investment in the exploration space, including four earn-in and joint venture agreements supporting potentially over A$200m of exploration expenditure covering over 10,000km2 in the Macquarie Arc and significant re-rating of exploration juniors in the Cobar district.

Kincora’s Projects:

-

- Sit in highly prospective locations of the key belts of the Lachlan Fold Belt

- Are advanced stages of exploration and/or host large scale footprints

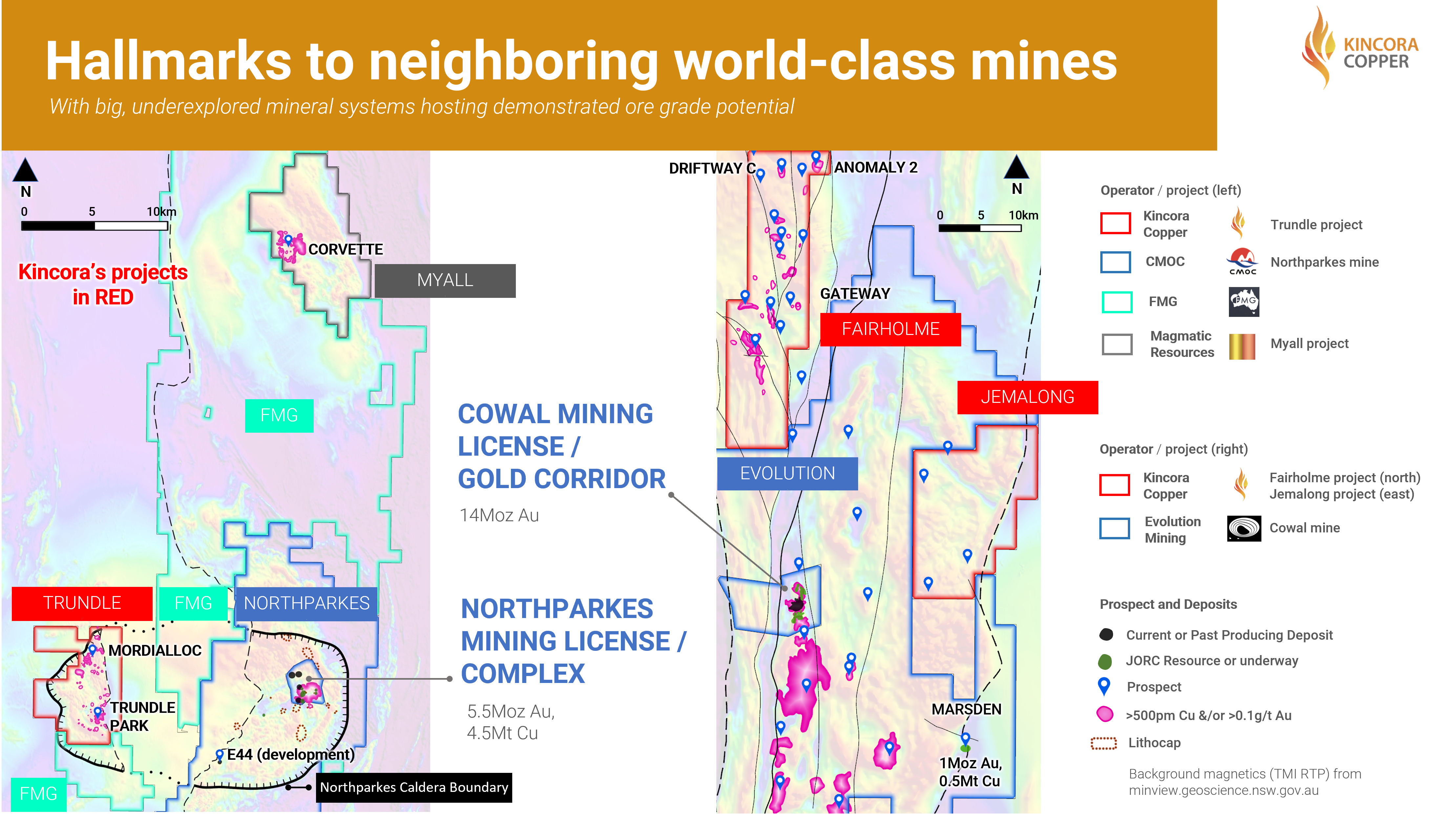

- Demonstrate hallmarks of neighbouring world-class deposits

- Benefit from existing infrastructure and favourable ESG considerations

During 2023, Kincora made three major shifts in corporate strategy to lay the foundations to create and realize value from its our district-scale porphyry project portfolios.

The first step taken was the strategic review process for the wholly owned Mongolian portfolio, following the Company’s focus having pivoted to NSW in 2019/2020 and with recent activities having capital efficiently advanced the Mongolian portfolio (including securing a mining license, announcing a maiden JORC resource and updated exploration target, and, making a new (third) intrusive complex discovery). This divestment process is ongoing and further announcements will be made as and when material developments are made. Field season activities, completed in 4Q’2023, met expenditure and community requirements, and support a high impact, modest cost proposed field program seeking to confirm a new down-hole major porphyry discovery, conversion of a second mining license (covering all three intrusive system complexes) and revisiting the economics of a near term development project of the existing oxide resource.

The second major shift in strategy was Kincora securing 100% ownership across all of the Australian projects (closed December 2023), concurrent with a strongly supported A$2 million capital raising. Consolidating the project ownership and removing the prior carried interests increases the strategic value and attractiveness of the projects and Australian project portfolio. This portfolio already attracted interest from mid-tier and industry majors.

Importantly this development enables a third leg to Kincora’s action plan, providing for a potential pivot in funding strategy and investors at the asset level, not solely at the listed company level. It is also a catalyst for on-going discussions and negotiations. The fundamental motivator is unlocking and providing a path for realising value for shareholders (with different potential structures for each project).

All NSW projects have designed drilling programs offering company making upside supported by strong technical merits designed by Kincora’s industry leading technical team.

In total these include a total of 30 drill ready targets for over 30,000m of drilling – see the following image

-

- In 2H’2024, Kincora announced the first new asset level partner, AngloGold Ashanti, via an up to $50m Earn-In/JV agreement for the Nyngan and Nevertire projects. Also in this period Exploration Alliance partner, Earth AI, commenced a maiden drilling of new AI generated copper targets at the Cundumbul project, and secure the highly prospective Wongarbon porphyry project. Kincora continues to seek to systematically advance and add value to all projects in the portfolio – see the last image

Background

In January 2020, Kincora executed a agreement with RareX Limited (“RareX”) that provided for a controlling interest in a portfolio of 6 advanced to early stage copper-gold exploration licenses that have demonstrated mineralisation and strategic appeal (eg previous investment by BHP, Rio Tinto, Newcrest, HPX/Kaizian Discovery (now Ivanhoe Electric), AngloGold Ashanti, Goldfields, Mitsubishi, St Barbara, Ramelius Resources, amongst others) .

In March 2020, Kincora acquire a 65% interest in the respective licenses, becoming operator and sole funder of all further exploration until a positive scoping study or preliminary economic assessment (“PEA”) was delivered on a license-by-license level basis.

In December 2023, Kincora acquired RareX’s remaining stake to increase its interest to 100% and remove the carried interest.

The vended Trundle (EL8222), Fairholme (EL6552 and EL6915), Jemalong (EL8502), Cundumbul (EL6661) and Condobolin (EL7748) licenses all host demonstrated large scale mineral systems and are located in highly prospective settings on proven mineral and mining belts of the Lachlan Fold Belt.

Consolidating the project ownership and removing the existing carried interests increases the strategic value of Kincora’s NSW project portfolio. The project portfolio already attracted interest from mid-tier and an industry majors, and with an ownership structure now in place that provides optionality for project level funding and other corporate transactions.

RareX is listed on the ASX with the ticker “REE”, and is formerly known as Sagon Resources and Clancy Exploration Limited. RareX is now focused on the development of its Cummins Range rare earths and Direct Shipping Ore (“DSO”) phosphate project in Western Australia. RareX is now Kincora’s largest shareholder with a ~18.2% interest.

In addition to the licenses acquired from RareX, Kincora was the first mover and secured directly from the NSW Government a district scale position in the interpreted northern undercover extension of the Macquarie Arc.

Kincora bet Fortescue and Inflection Resources (its subsequent earn-in partner Anglo-Gold Ashanti) to the most prospective and shallow to moderate depth sections of the interpreted northern extension of the Junee-Narromine Belt.

Due to post mineral cover there has been very limited prior drilling in this section of the belt relative to the southern section (which hosts >160Moz gold equivalent).

The Northern Junee-Narromine Belt (“NJNB”) offers new district-scale discovery potential with spatial and temporal settings, coupled with magnetics, supportive of large-scale (Cadia-scale) targets analogous to porphyry deposits located in the southern section of the Macquarie Arc and other globally significant porphyry districts.