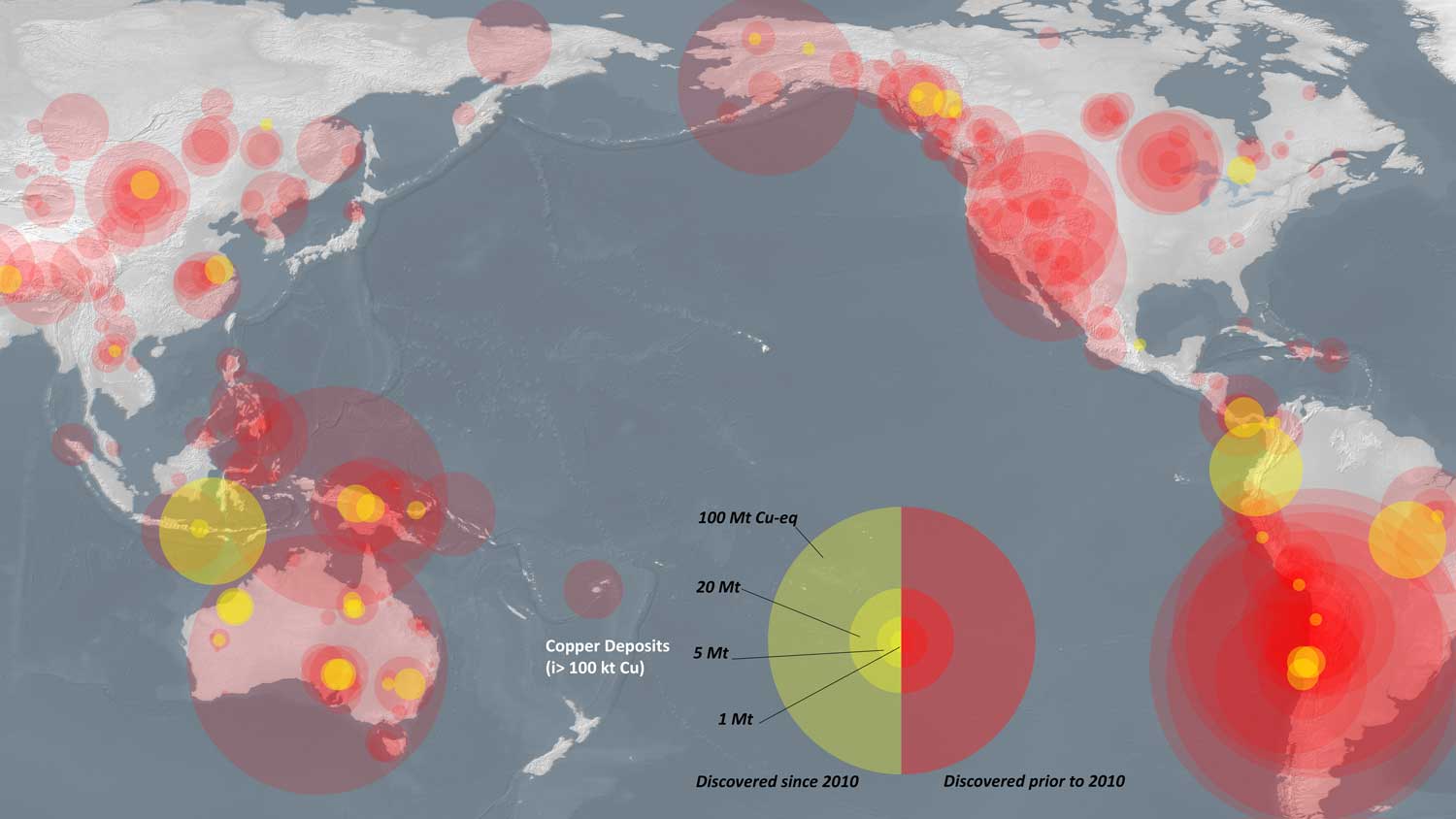

A contributing factor for the favourable re-rating of copper exploration success stories is the lack of new discoveries within the sector and advanced exploration and development projects in the pipeline.

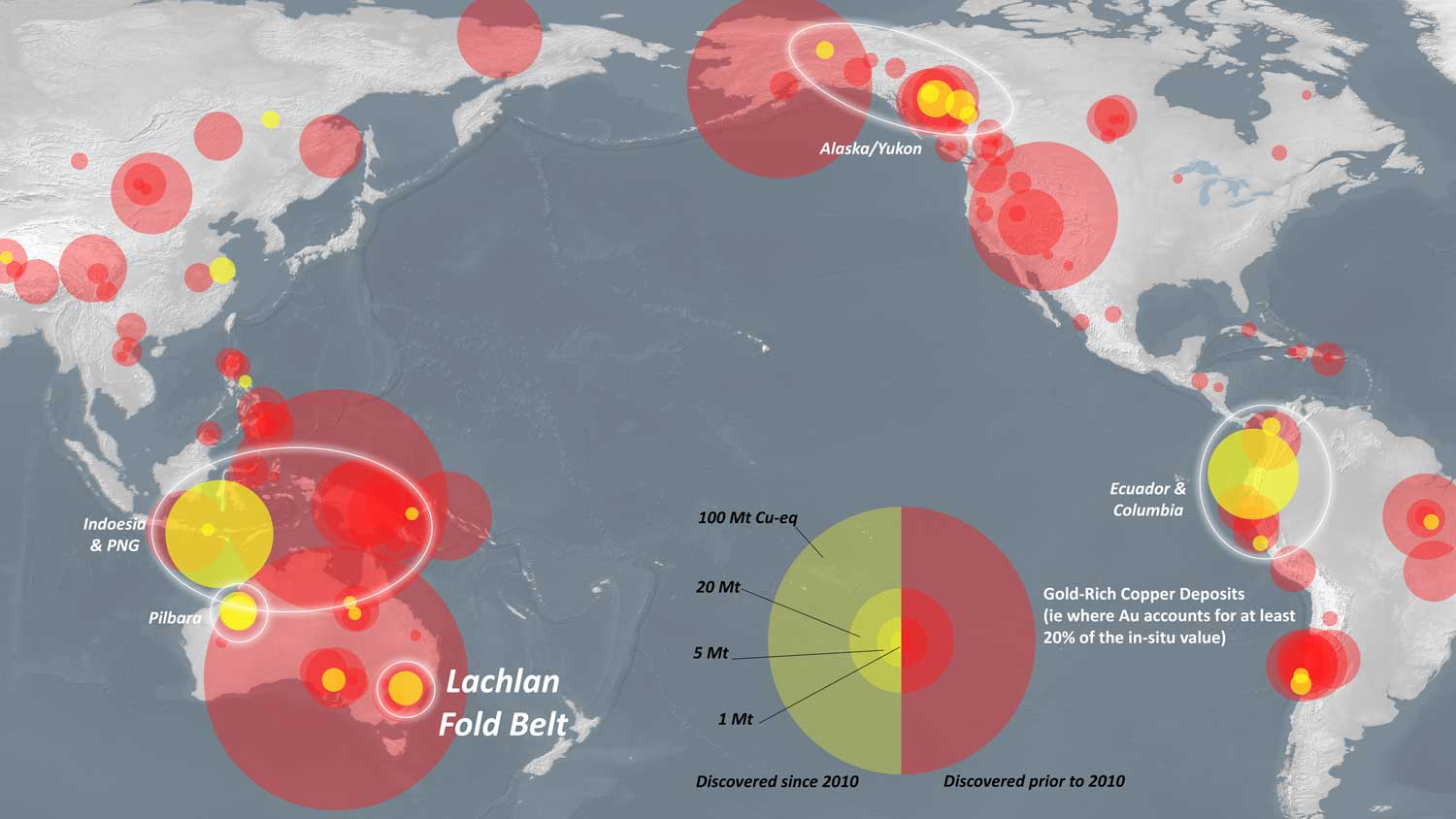

This trend is in part evident from the below figures which highlights the lack of discoveries over the last decade, particularly from South America that is the largest source of existing primary copper supply. This analysis also illustrates the location of existing deposits, a large portion in emerging/frontier and/or ESG sensitive markets, and of new gold rich copper deposits, with increasingly different commodity price trends for by-product credits impacting the differences in new exploration and development project economics (eg molybdenum versus gold price credits).

a) All copper deposits in the World, highlighting those found in the last decade

– LHS (source MinEx Consulting, bespoke request for Kincora – January 2021)

b) Gold-rich copper deposits found in the World in the last decade and the 5 current hot spots for exploration – RHS (source MinEx Consulting, bespoke request for Kincora – January 2021)

The global copper sector is currently struggling to sustain existing production levels, and mid-major industry players have generally consolidated new globally significant discoveries through the cycle. This is particularly the case on the ASX with few advanced exploration or development stage copper plays, particularly with assets in Tier 1 jurisdictions. The first two figures also reinforce the latter point, illustrating the locations for the current five “hotspots” for copper and gold system exploration, two in Australia, and others located in ESG sensitive and/or emerging/frontier market jurisdictions.

A further case study supporting this trend is Rio Tinto fast tracking its Winu discovery in Western Australia to a smaller scale construction decision. Rio Tinto is deviating from its traditional focus on only Tier 1 assets, often in higher risk jurisdictions.

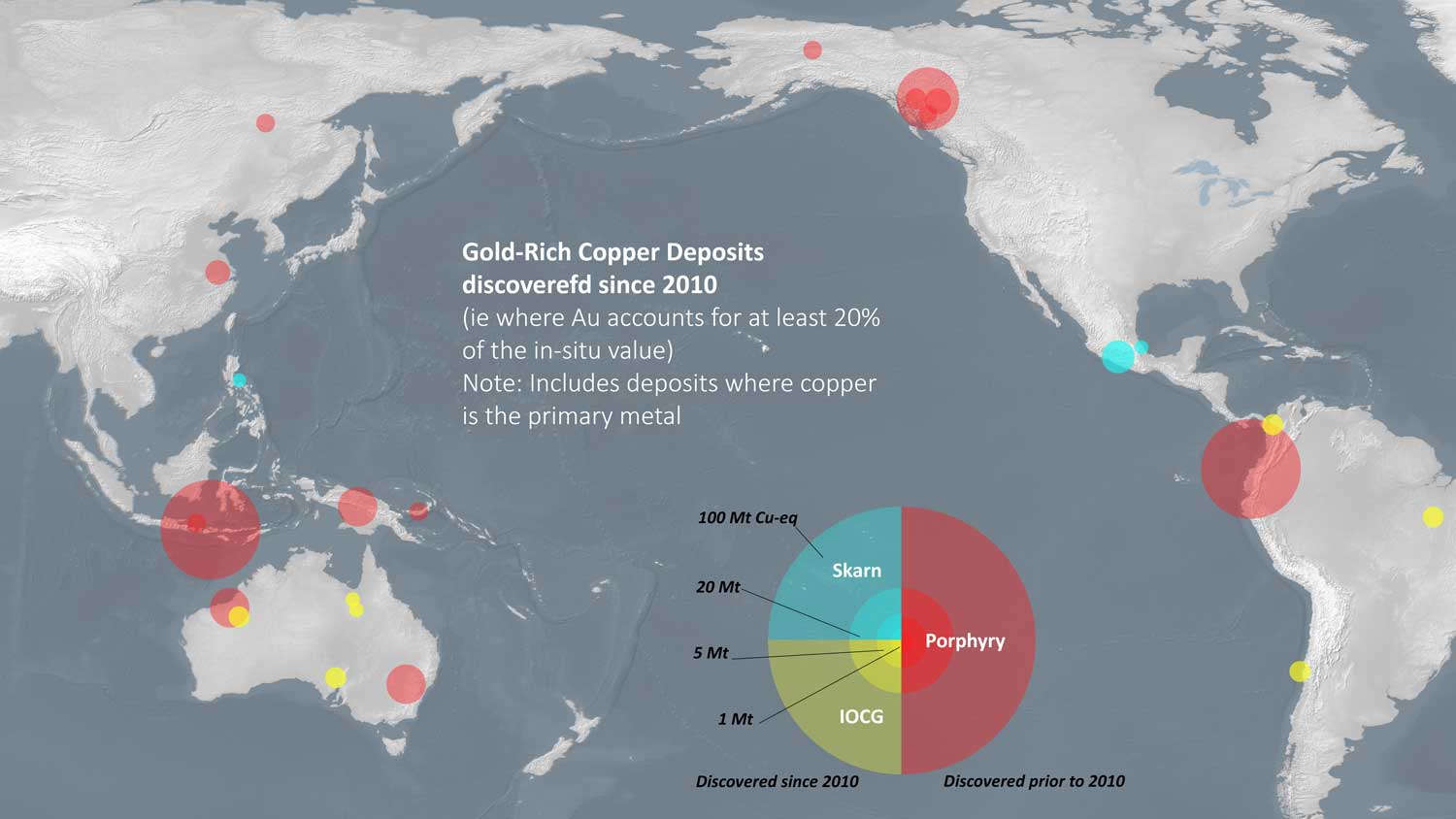

Gold rich copper porphyries are the style of mineralization and deposit preference for the majors in seeking copper exposure. This is driven by the generally significant by-product credits (from gold system credits) and size of the deposit (that provides a long life and relatively simple and cost effective mining operation). As the below figure highlights, porphyry style copper systems dominate the global landscape for all gold rich copper discoveries in the last decade, and further illustrates the industry’s lack of new discovery success and the strategic value of a new globally significant discovery.

All gold-rich copper deposits found in the World in the last decade, broken down by deposit style – LHS

(source MinEx Consulting, bespoke request for Kincora – January 2021)

While the majority of new significant copper supply is from frontier/emerging markets (eg the DRC, Mongolia, Ecuador etc) there is increasingly preference from the major copper producers and western capital markets to invest in more developed jurisdictions (eg Canada, USA and Australia).

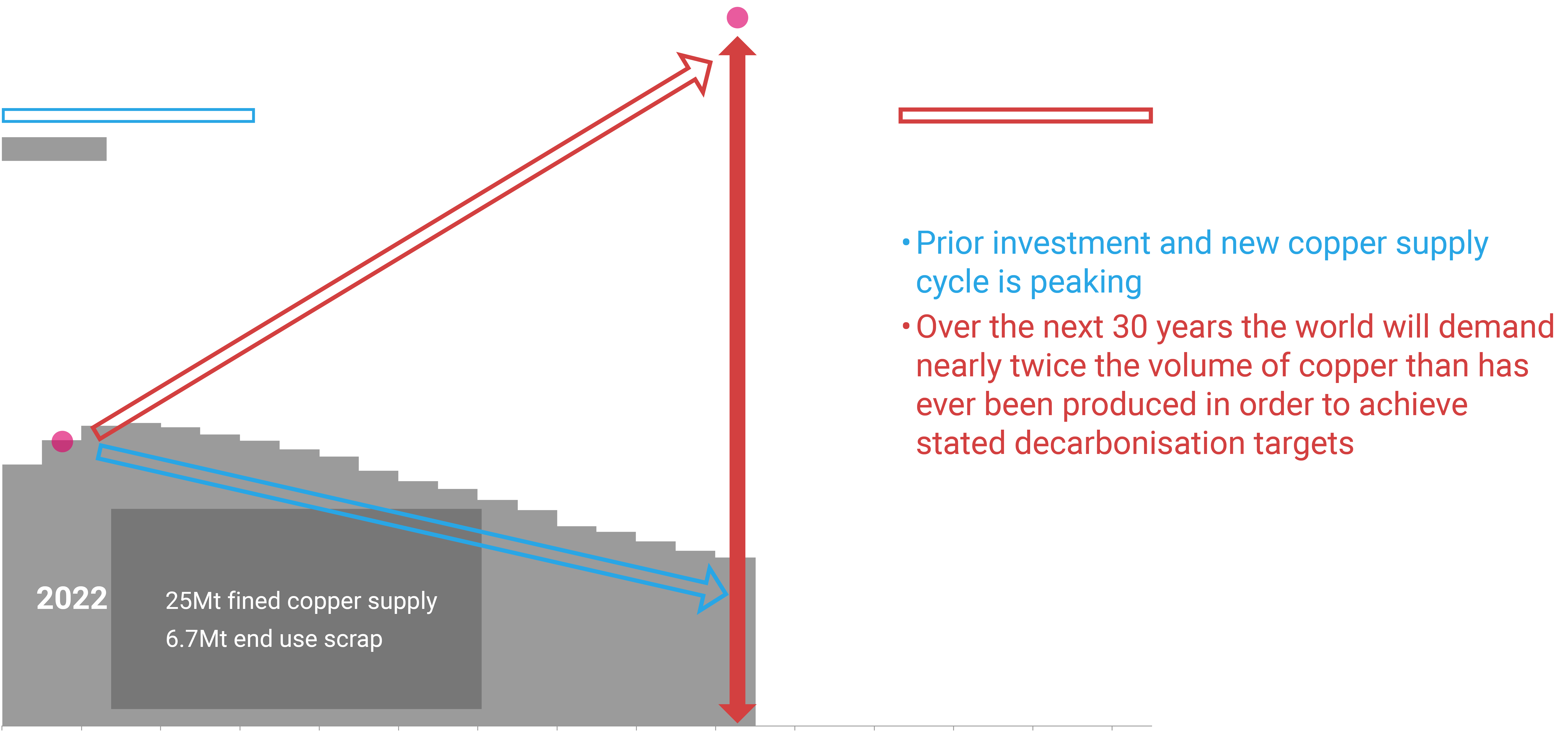

In Kincora’s view, while copper remains fundamentally a supply side story driven by the shortfall of new projects, an increasingly favourable copper demand scenario is emerging, underpinned by:

- continued longer term industrial growth, led by China;

- expected significant nearer term government stimulus post COVID-19 driven contractions in economic growth; and,

- increasing trend towards decarbonisation and electrification (which requires significantly more copper than equivalent carbon sources).

Regarding only the latter, BHP estimates that copper production will have to double over the next 30 years to satisfy these new demands5. In the Company’s view, investors are beginning to understand these fundamental requirements more clearly now and this is seen in recent copper price moves.

The recent positive correlation between the gold and copper price is also particularly noteworthy given the gold rich endowment of copper porphyries in the Macquarie Arc. The gold price has been and continues to be strong, increasing from US$1517/oz at the beginning of 2020, to US$1765/oz at the end of June 2020, and currently at US$1808/oz (as at 24 February 2021). The uncertainty and financial impact, including expected significant government stimulus packages and quantitative easing, from COVID-19 has been a positive catalyst for the gold price.

1 Bespoke request by Richard Schodde from MinEx Consulting for Kincora Copper, March 2020

2 Richard Schodde from MinEx Consulting presentation to the 2018 NSW Minerals Council Exploration Forum, May 2018, – available at: http://minexconsulting.com/the-strategic-benefits-to-governments-in-supporting-exploration-2/

3 Bespoke analysis by opaxe.com for Kincora Copper, July 2020

opaxe is a proprietary database of announcements published by resources companies listed on the world’s major stock exchanges: www.opaxe.com

Recent notable exploration results for selected Australian based new discoveries.

All projects are represented by initial or earliest notable publically available drill hole data.

Please note further details and disclosures on slides 6, 7 and 38 of Kincora’s July 2020 presentation for further details – available at: https://www.kincoracopper.com/media/downloads/presentations/corporate-presentation-7-23-2020.pdf .

4 “The Assay” video interview with Richard Schodde and John Holliday, April 2020 – available at https://www.theassay.com/the-assay-tv/the-assay-tv-richard-schodde-john-holliday-kincora-copper/?dm_t=0,0,0,0,0

5 Reuters, December 3, 2020 article “BHP says copper output needs to double in 30 years, criticises pricing system”