Multiple world-class mines with multiple deposits

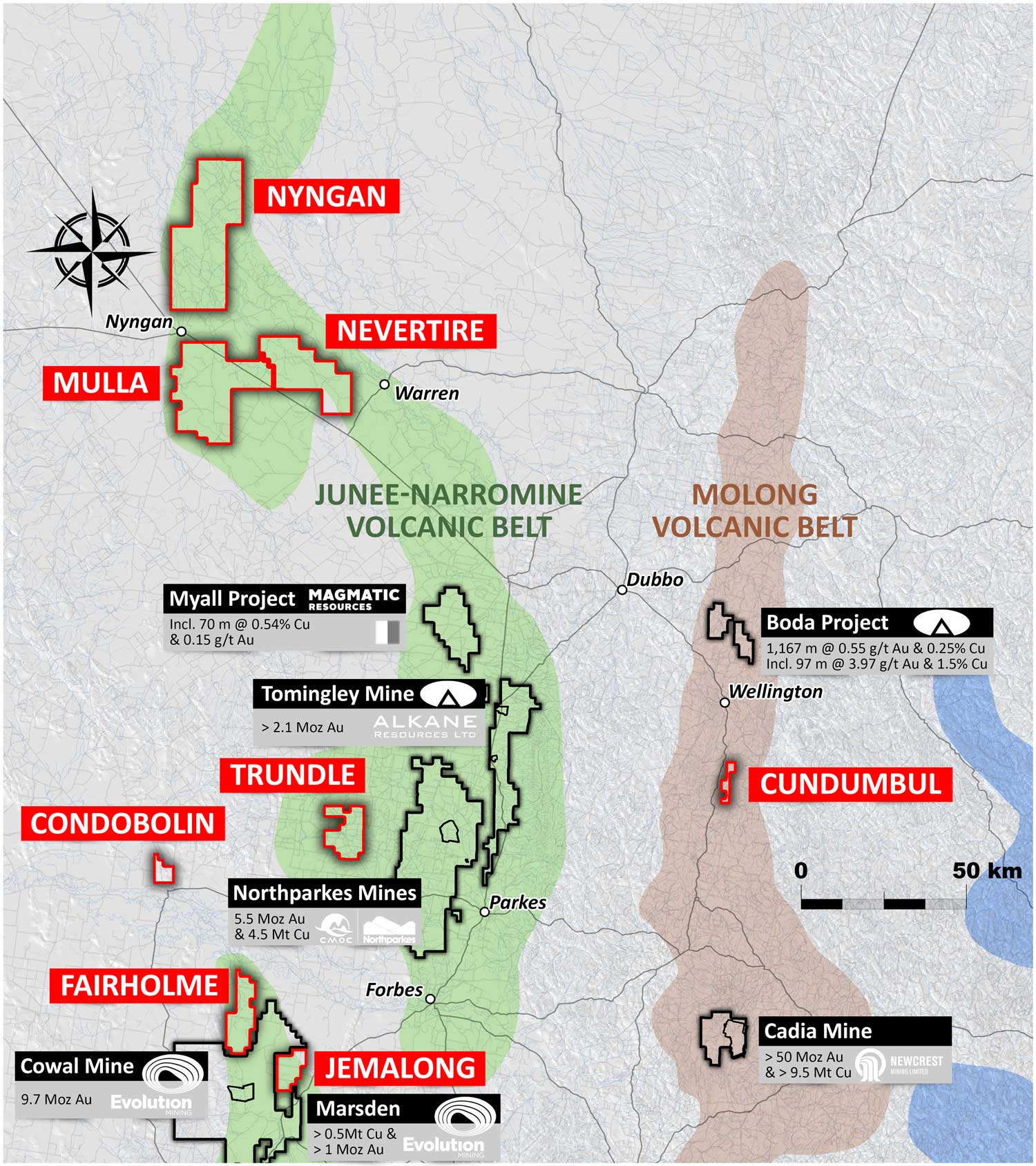

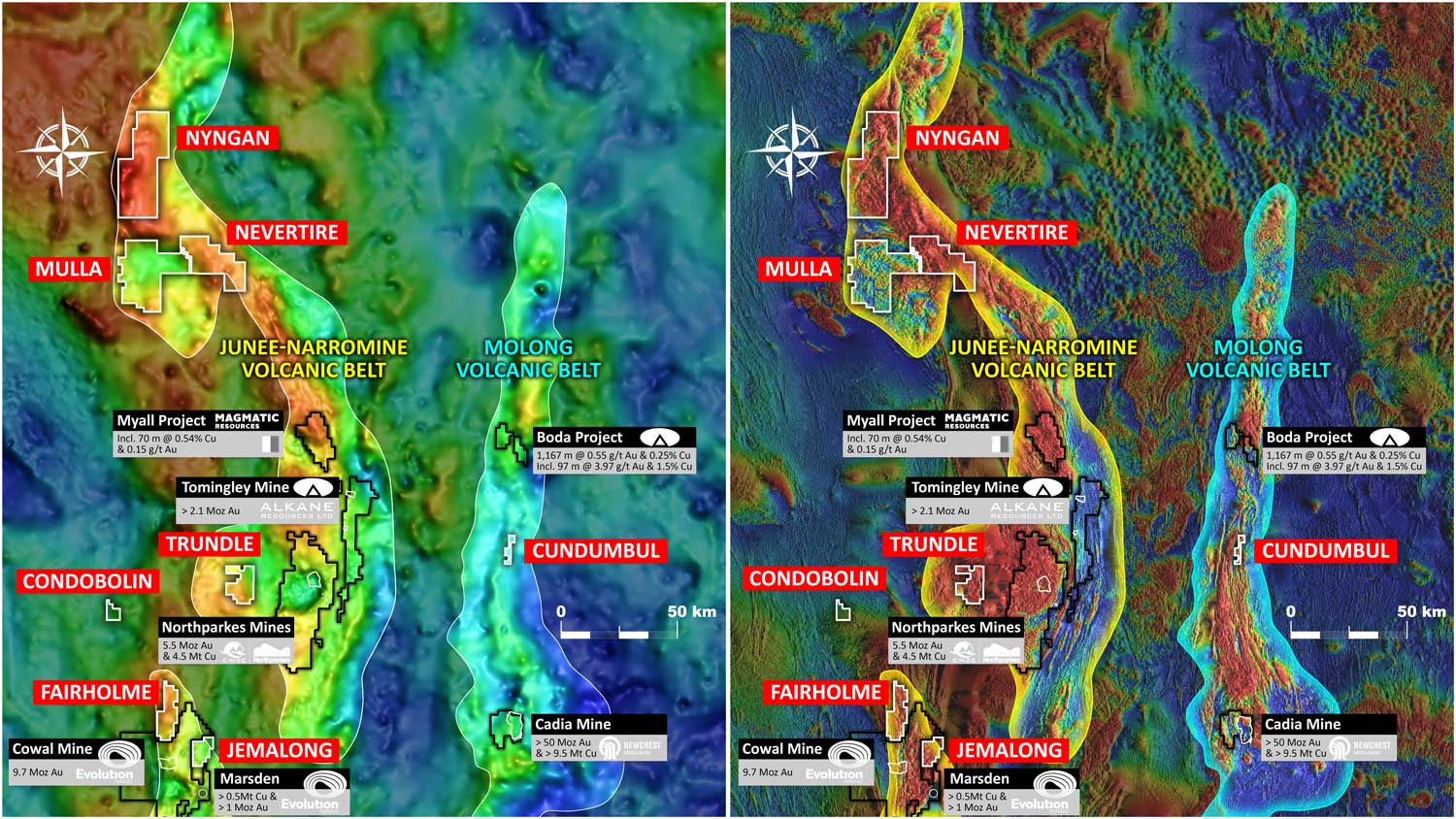

Kincora holds a wholly owned district-scale project portfolio in the Central-West of New South Wales (NSW), centered on Australia’s prolific Macquarie Arc and Cobar Superbasin of the Lachlan Fold Belt. The region is a world class Gold-Copper province and the Macquarie Arc is Australia’s foremost porphyry district.

The corporate appeal of the district is evident from the multiple billion dollars of M&A during 2023. These transactions include one of the worlds’ most profitable hard rock projects (Cadia), the CSA mine (A$1.3 billion) and Northparkes (80% for up to A$720m), to multiple significant exploration focused transactions (including AngloGold Ashanti’s earn-in deal with Inflection Resources for up to A$145m including current 35,000m drill program).

Kincora’s Projects:

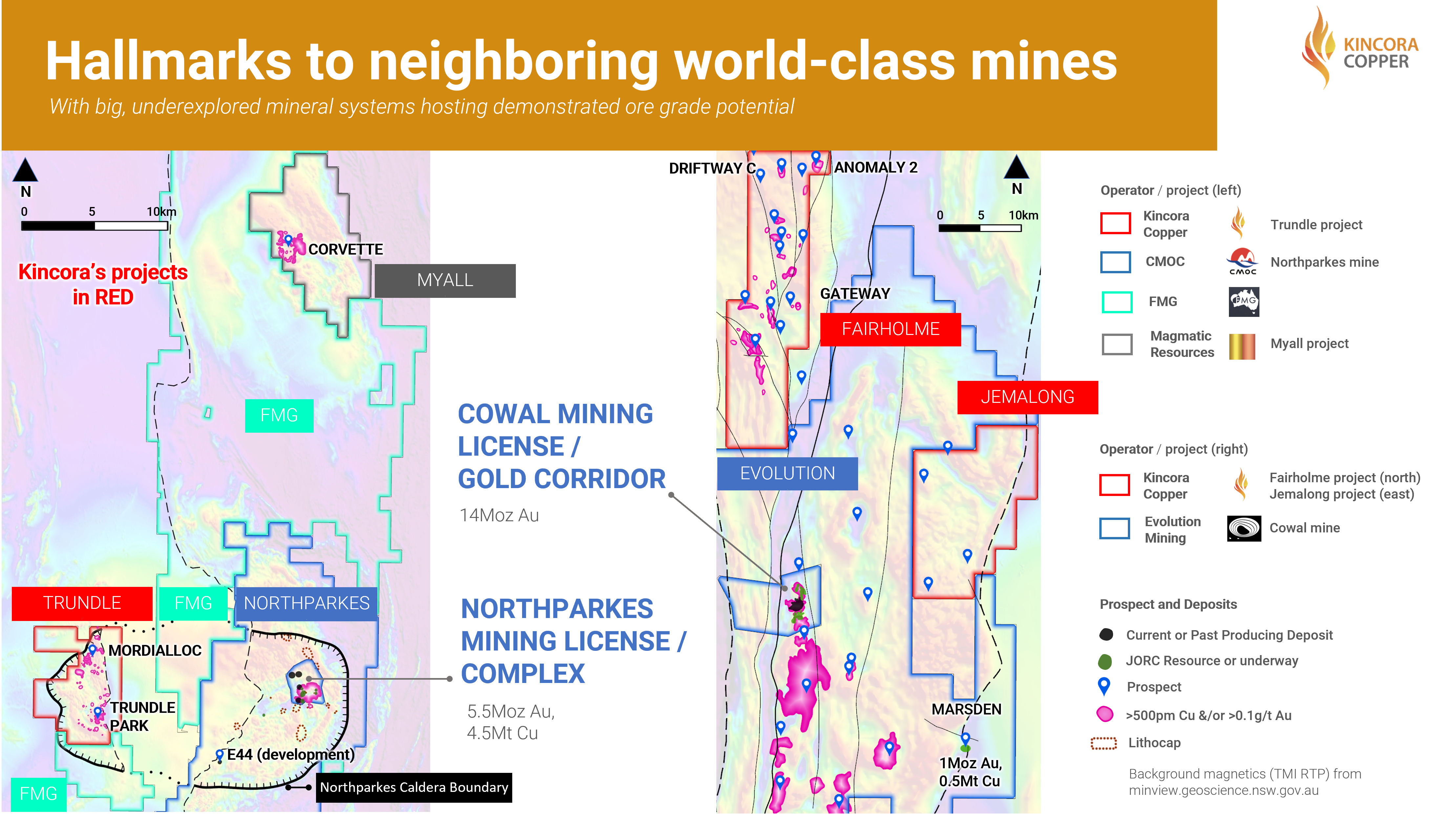

- Sit in highly prospective locations of the key belts of the Lachlan Fold Belt

- Are advanced stages of exploration and/or host large scale footprints

- Demonstrate hallmarks of neighbouring world-class deposits

- Benefit from existing infrastructure and favourable ESG considerations

Having successfully run a strategic review and pending divestment for Kincora’s wholly owned Mongolian porphyry projects and recently buying out the original project vendor for its NSW projects, Kincora owns a 100% interest in all its NSW projects and is seeking potential asset partners for its Tier-1 scale copper-gold porphyry projects. These core projects include Trundle, Fairholme (+/- Jemalong), and, the Northern Junee-Narromine Belt (“NJNB”) portfolio (Nyngan, Nevertire and Mulla licenses).

Exploration alliance partner and artificial intelligence explorer, Earth AI, is expected to commence drilling in the first quarter of 2024 (at their own cost) at the Cundumbul project, with 2023 Kincora drilling at the Condobolin project returning encouraging results with the permitting processes commenced to follow up down dip and stepping out at the Meritilga prospect.

All NSW projects have designed drilling programs offering company making upside supported by strong technical merits designed by Kincora’s industry leading technical team.

Background

In January 2020, Kincora executed a agreement with RareX Limited (“RareX”) that provided for a controlling interest in a portfolio of 6 advanced to early stage copper-gold exploration licenses that have demonstrated mineralisation and strategic appeal (eg previous investment by BHP, Rio Tinto, Newcrest, HPX/Kaizian Discovery (now Ivanhoe Electric), AngloGold Ashanti, Goldfields, Mitsubishi, St Barbara, Ramelius Resources, amongst others) .

In March 2020, Kincora acquire a 65% interest in the respective licenses, becoming operator and sole funder of all further exploration until a positive scoping study or preliminary economic assessment (“PEA”) was delivered on a license-by-license level basis.

In December 2023, Kincora acquired RareX’s remaining stake to increase its interest to 100% and remove the carried interest.

The vended Trundle (EL8222), Fairholme (EL6552 and EL6915), Jemalong (EL8502), Cundumbul (EL6661) and Condobolin (EL7748) licenses all host demonstrated large scale mineral systems and are located in highly prospective settings on proven mineral and mining belts of the Lachlan Fold Belt.

Consolidating the project ownership and removing the existing carried interests increases the strategic value of Kincora’s NSW project portfolio. The project portfolio already attracted interest from mid-tier and an industry majors, and with an ownership structure now in place that provides optionality for project level funding and other corporate transactions.

RareX is listed on the ASX with the ticker “REE”, and is formerly known as Sagon Resources and Clancy Exploration Limited. RareX is now focused on the development of its Cummins Range rare earths and Direct Shipping Ore (“DSO”) phosphate project in Western Australia. RareX is now Kincora’s largest shareholder with a ~18.2% interest.

In addition to the licenses acquired from RareX, Kincora was the first mover and secured directly from the NSW Government a district scale position in the interpreted northern undercover extension of the Macquarie Arc.

Kincora bet Fortescue and Inflection Resources (its subsequent earn-in partner Anglo-Gold Ashanti) to the most prospective and shallow to moderate depth sections of the interpreted northern extension of the Junee-Narromine Belt.

Due to post mineral cover there has been very limited prior drilling in this section of the belt relative to the southern section (which hosts >160Moz gold equivalent).

The Northern Junee-Narromine Belt (“NJNB”) offers new district-scale discovery potential with spatial and temporal settings, coupled with magnetics, supportive of large-scale (Cadia-scale) targets analogous to porphyry deposits located in the southern section of the Macquarie Arc and other globally significant porphyry districts.

LACHLAN FOLD BELT

Multiple world-class mines with multiple deposits

Kincora holds a wholly owned district-scale project portfolio in the Central-West of New South Wales (NSW), centered on Australia’s prolific Macquarie Arc and Cobar Superbasin of the Lachlan Fold Belt. The region is a world class Gold-Copper province and the Macquarie Arc is Australia’s foremost porphyry district.

The corporate appeal of the district is evident from the multiple billion dollars of M&A during 2023. These transactions include one of the worlds’ most profitable hard rock projects (Cadia), the CSA mine (A$1.3 billion) and Northparkes (80% for up to A$720m), to multiple significant exploration focused transactions (including AngloGold Ashanti’s earn-in deal with Inflection Resources for up to A$145m including current 35,000m drill program).

Kincora’s Projects:

- Sit in highly prospective locations of the key belts of the Lachlan Fold Belt

- Are advanced stages of exploration and/or host large scale footprints

- Demonstrate hallmarks of neighbouring world-class deposits

- Benefit from existing infrastructure and favourable ESG considerations

Having successfully run a strategic review and pending divestment for Kincora’s wholly owned Mongolian porphyry projects and recently buying out the original project vendor for its NSW projects, Kincora owns a 100% interest in all its NSW projects and is seeking potential asset partners for its Tier-1 scale copper-gold porphyry projects. These core projects include Trundle, Fairholme (+/- Jemalong), and, the Northern Junee-Narromine Belt (“NJNB”) portfolio (Nyngan, Nevertire and Mulla licenses).

Exploration alliance partner and artificial intelligence explorer, Earth AI, is expected to commence drilling in the first quarter of 2024 (at their own cost) at the Cundumbul project, with 2023 Kincora drilling at the Condobolin project returning encouraging results with the permitting processes commenced to follow up down dip and stepping out at the Meritilga prospect.

All NSW projects have designed drilling programs offering company making upside supported by strong technical merits designed by Kincora’s industry leading technical team.

Background

In January 2020, Kincora executed a agreement with RareX Limited (“RareX”) that provided for a controlling interest in a portfolio of 6 advanced to early stage copper-gold exploration licenses that have demonstrated mineralisation and strategic appeal (eg previous investment by BHP, Rio Tinto, Newcrest, HPX/Kaizian Discovery (now Ivanhoe Electric), AngloGold Ashanti, Goldfields, Mitsubishi, St Barbara, Ramelius Resources, amongst others) .

In March 2020, Kincora acquire a 65% interest in the respective licenses, becoming operator and sole funder of all further exploration until a positive scoping study or preliminary economic assessment (“PEA”) was delivered on a license-by-license level basis.

In December 2023, Kincora acquired RareX’s remaining stake to increase its interest to 100% and remove the carried interest.

The vended Trundle (EL8222), Fairholme (EL6552 and EL6915), Jemalong (EL8502), Cundumbul (EL6661) and Condobolin (EL7748) licenses all host demonstrated large scale mineral systems and are located in highly prospective settings on proven mineral and mining belts of the Lachlan Fold Belt.

Consolidating the project ownership and removing the existing carried interests increases the strategic value of Kincora’s NSW project portfolio. The project portfolio already attracted interest from mid-tier and an industry majors, and with an ownership structure now in place that provides optionality for project level funding and other corporate transactions.

RareX is listed on the ASX with the ticker “REE”, and is formerly known as Sagon Resources and Clancy Exploration Limited. RareX is now focused on the development of its Cummins Range rare earths and Direct Shipping Ore (“DSO”) phosphate project in Western Australia. RareX is now Kincora’s largest shareholder with a ~18.2% interest.

In addition to the licenses acquired from RareX, Kincora was the first mover and secured directly from the NSW Government a district scale position in the interpreted northern undercover extension of the Macquarie Arc.

Kincora bet Fortescue and Inflection Resources (its subsequent earn-in partner Anglo-Gold Ashanti) to the most prospective and shallow to moderate depth sections of the interpreted northern extension of the Junee-Narromine Belt.

Due to post mineral cover there has been very limited prior drilling in this section of the belt relative to the southern section (which hosts >160Moz gold equivalent).

The Northern Junee-Narromine Belt (“NJNB”) offers new district-scale discovery potential with spatial and temporal settings, coupled with magnetics, supportive of large-scale (Cadia-scale) targets analogous to porphyry deposits located in the southern section of the Macquarie Arc and other globally significant porphyry districts.